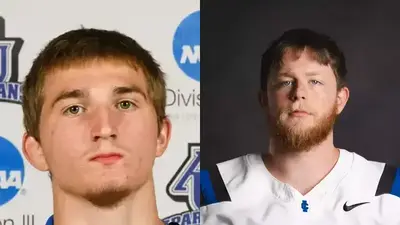

Saying he’s grown tired of seeing too many friends and families forced to leave the state for better opportunities, state Rep. Tom Demmer (R-Dixon) announced his run for state treasurer against incumbent Michael Frerichs.

“Springfield politicians’ answer to every problem is higher taxes and more spending,” the House Deputy Republican Leader tweeted. “Our hardworking families have had enough. That’s why I’m running for state treasurer, I will be a fiscal watchdog to help turn things around and get Illinois back on track.”

In formally launching his campaign, Demmer, a member of the General Assembly for nearly a decade, also accused Frerichs and other lawmakers of allowing taxation and overspending to swell out of control.

“When Illinois families leave, it’s our communities that pay the price, as corruption and bloated government drain taxpayer dollars away from schools, public safety, and community services,”

Demmer blasted Frerichs for spending his 15-year career in Springfield “supporting tax increases,” including the failed 2020 Fair Tax amendment proposed by Gov. J.B. Pritzker.

Demmer is the first Republican to challenge Frerichs since 2015. Demmer blasted Frerichs over remarks he made in June of 2020 when he voiced support for allowing taxes on retirement income as part of Pritzker’s proposed graduated-rate tax system.

“The vast majority of Illinoisans have not heard of Mike Frerichs but he stands tall among the tax-and-spend Springfield crowd,” he told the Chicago Tribune. “Throughout his 15 years as a Springfield politician, Mike Frerichs continually voted to raise taxes. And now, he even wants to tax retirement.”

In Illinois, the treasurer position handles the state’s finances in partnership with the comptroller’s office. While the comptroller focuses on paying bills, the treasurer’s office invests state money.

Demmer recently proposed measures to combat the state's largest jump in inflation in three decades.

“That's why today we're proposing an up-to $400 refundable tax credit for Illinois taxpayers across the state,” he said at a recent news conference. “Our proposal mirrors some of the financial aid that was given by the federal government in the last couple of years. Our proposal would call for single filers (who make) up to $75,000 in income to receive $200. Joint filers (who make) up to $150,000 to receive $400 and head of household filers (who make) up to $112,000 to receive $200.

Alerts Sign-up

Alerts Sign-up